Help Articles & FAQ

Understanding Interchange Plus Pricing

(Feel free to comment and post your own questions. Free help & support.)

Understanding your statement should not require an MBA from Harvard. The first thing to understand about fees is where they go precisely.

Interchange Plus Pricing

Honest. Fair. Transparent. Easy.

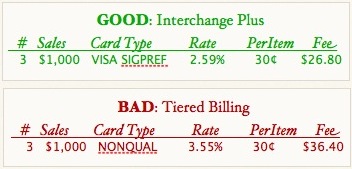

There is a reason only the largest, wealthiest and most powerful corporations accept credit cards only with Interchange Plus Pricing: it is the best.

Each Card type is revealed along with its actual interchange rate on an Interchange Plus merchant statement. The rate includes each card’s percentage rate and its Per Item fee.

Remember that Associations price the same cards differently depending on your business industry. This, they say, is because certain business types are at far less risk, and others are at far greater risk of fraud, leading to disputes, chargebacks and potential litigation.

Example: public utility companies, like gas, electric and water utilities have virtually zero disputes of credit card charges. Because of this, Associations like Visa and MasterCard both only charge them 0% rate on credit and debit cards. E-Commerce companies, like Amazon or eBay are assessed 2% or more on the very same credit cards. They insist that it’s fair because of risk.

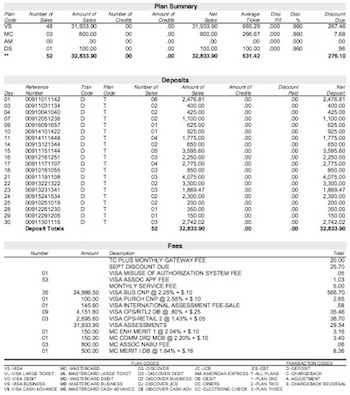

Here's an example of an Interchange Plus merchant statement.

When you accept a credit card from a customer, you have NO idea which type of Visa or MasterCard it is. They all have 16 digits, 4 digit expiration, and 3 digit CVV2 code. Here is one hint: if the approval code comes back with letters in it, then it is a corporate or purchasing card.

Card Associations surcharge for:

- rewards cards

- travel/entertainment cards

- international/foreign cards

- preferred cards (no credit limit)

- commercial cards

- business cards

- corporate cards

- commercial electronic

- purchasing cards

- and many more!

Example Statements: When you don’t know the actual card type, you have no way of knowing the true rate of the card and how much it’s been marked up or padded!

Risk Assessment

Associations charge MORE when they assess higher risk. For example, oftentimes business cards get abused, stolen and employers commonly dispute transactions. So as you might expect, business cards often have the highest surcharges. Cards from foreign (non-U.S.) banks and addresses also have a high incidence of fraud, plus may require currency conversion, so foreign cards are assessed higher rates. As you might imagine then, a foreign business card would be the highest possible card rate.

Debit Cards Cost Merchants Less

Because Debit cards have the least risk of fraud, Issuing Banks give a Rebate of about 0.5% on all debit cards. Not only do many Processors keep this rebate without passing it on to Merchants, some actually charge MORE for it!

Interchange

The list of these Surcharges on all their card types is called Interchange and can be found on our glossary page here.

Factors causing cards to downgrade*

- key entered or card not present: +0.31%

- transaction not settled in 24 hours: +1.2%

- AVS failure: +0.76%

- sales tax or P.O. # ignored: +0.5%

- all verification prompts ignored: +1.37%

* Downgraded rate increases, above, are added in addition to normal card rates and may vary due to minor differences between associations.

Call our Merchant Relations consultants for free help, quotes or analysis of your current merchant statement or for new service at

Call our Merchant Relations consultants for free help, quotes or analysis of your current merchant statement or for new service at